Hello, Konnichiwa!

This Tokyo Box Breakout Strategy is very simple, not complicated, so anyone can do. And you don’t need any indicators to do this.

I will explain this strategy in 3 simple steps and then talk about why this strategy works.

And I will explain this by using the live moving chart, so let’s start right now!

Watch Video

What are Boxes?

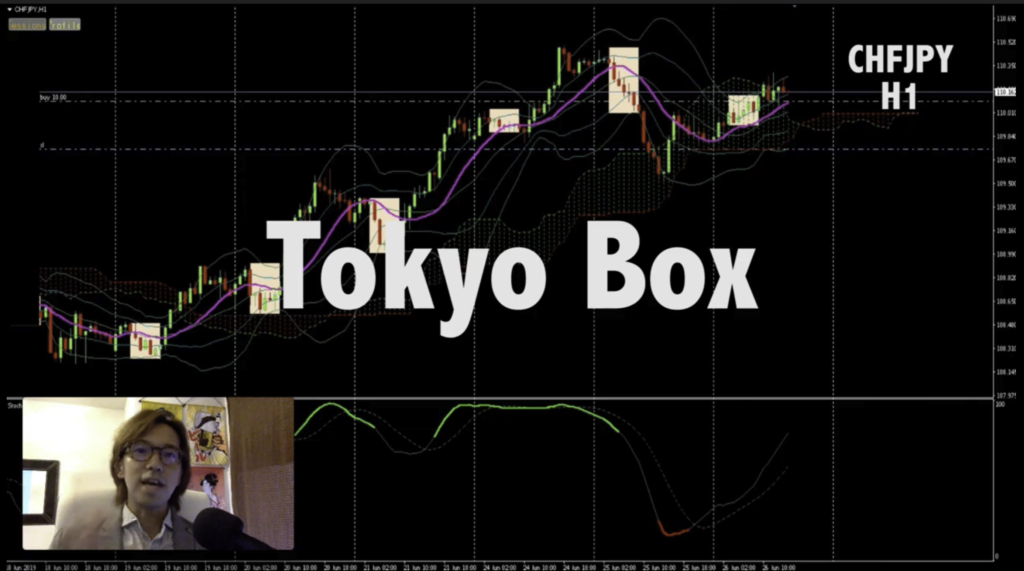

This is the 1H chart but look at these square boxes. These are what I call, Tokyo box.

This is the 1H chart but look at these square boxes. These are what I call, Tokyo box.

They show the time between Tokyo’s open and close time, which is between 9:00am and 3:00pm in Tokyo time, which is between 0:00am and 6:00am in UTC time zone.

So these are basically the Tokyo sessions and let me tell you how you can trade with 3 simple steps.

3 Steps to trade with Tokyo Box Strategy

- Highlight the Tokyo session after 6:00am UTC. That way you know exactly where the highest and lowest price of the Tokyo session on that day.

- 2. If the price is still within that range, and usually it is, place buy stop a little over the range, and place sell stop a little bit lower price level of that range.

- 3. Place stop loss below or above the Tokyo session or somewhere in the middle where there’s a push back or pull back happening.

That’s it!

And here is why it works and it relates to the tendency of traders in Japan. I am a Japanese trader so I know this well but most of the traders in Japan does contrarian trading approach, meaning they sell when it’s on bullish trend and they buy when it’s on bearish trend. I don’t say all the traders in Japan are like that, but I know we like to trade like that at times, you know, we place buy or sell limit orders usually on like the exact number or resistance or support line, and trade with contrarian approach. And that’s one of the reasons why there’s not so much volatility in Tokyo session although it’s the third biggest financial market in the entire world.

But think what happens when trades trade with contrarian approach?

You know, what happens when people trade within the range, keep selling from the top of the range and keep buying from the bottom of the range? What’s gonna happen is it accumulates stop loss above or below the range, right? And when the price breaks on either direction towards outside of the range, it’s not just because there are people who buy or sell at that point, but that’s because there are people who are getting their loss cut and the price keeps moving that way. And that’s the basic mechanism of the range break.

So in Tokyo session, because lots of Japanese trades trade in contrarian approach, the stop loss accumulates outside of the Tokyo box. And who is hunting the stop loss of Tokyo session? The London session guys. They look for where the stop loss is accumulated in Tokyo session, and as soon as they come in to the market in London time, they start to hunt the stop loss. And that’s the reason why after the price breaks the Tokyo box, a trend extends toward that direction.

Which currency pair does it work?

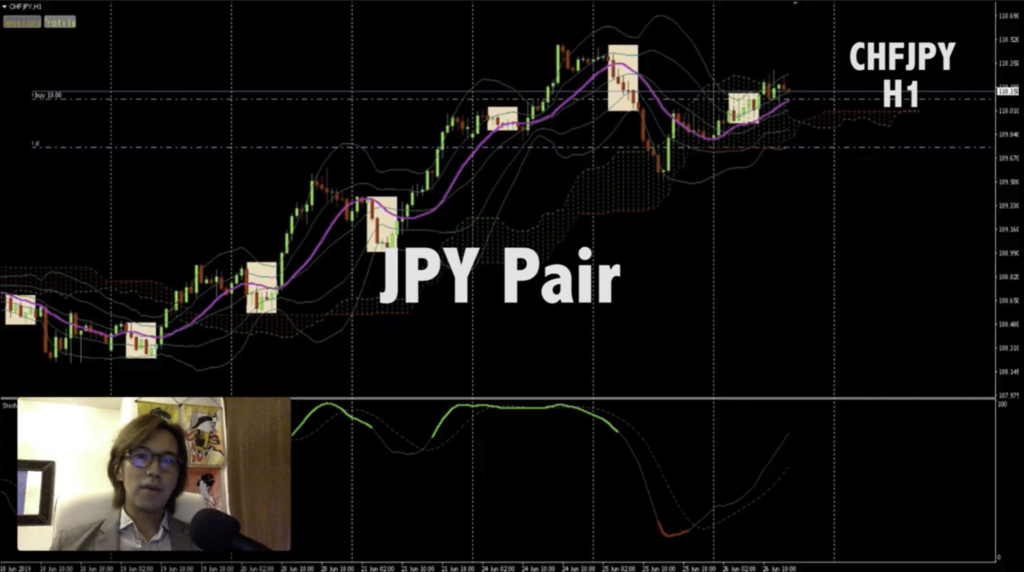

Now, one thing I wanna remind you is that this strategy does not work in all the currency pairs.

There are certain pairs that work with this Tokyo box strategy.

So the next question is, which currency pair does this strategy work?

The answer is any Japanese Yen pair.

So like, EURJPY, GBPJPY, AUDJPY, this CHFJPY, including USDJPY dollar straight pair, or any other currency pairs with JPY, it tends to work.

2 things you should be careful when using this strategy

Now, there are two things you should be careful when using this strategy.

One is when there’s some kind of big fundamental news related to the pair, in that case, you should watch out because the price could spike on either direction no matter what. So always make sure to check the economic news on that day related to any currency pairs.

And second thing is that before you trade with this strategy, look back the history and see if it’s been working for like the past 3 days at least. That way, the chance of winning with this strategy becomes higher. So instead of just placing orders right after identifying the Tokyo box, look back and see if it’s been working for the past 3 days and if it does, then apply it.

Example of Tokyo Box Breakout Strategy

For example, Look at this CHFJPY in H1 and look at the history.

Here, when the price breaks Tokyo Box, it goes down or up every time, right? So as you can see, on this currency pair, it’s been working like that until yesterday. So what’s gonna happen when it breaks today? Most likely, it’s gonna go up, right? and that’s why I placed long a while ago and currently running like $600 to $700 profit and I am expecting to go up further.

But look at this USDJPY above. You see, seems it’s not working on this pair, right? like when it breaks, it goes back down or up recently. So you don’t want to trade this currency pair with the Tokyo Box breakout strategy because it’s obvious that it’s not been trustable recently.

The good things about this strategy is that it’s not only simple, but you don’t have to be keep watching the price action and place orders. You can just place buy or sell stop after you confirm the Tokyo box, and leave it. You know, go out and have fun with your family or friends or lovers or whoever, and look forward to the outcome. But make sure to place stop loss and get the risk reward ratio so that you know what risk you are taking on that trade.

So look around at any JPY pair charts today, and check if the Tokyo box breakout has really been working for the past few days, then you have a chance to earn money today after 6am UTC.

What happened after a while with this strategy

Ok, here is a chart after a while. As you see, it’s breaking upwards and currently running like $1,300 profit. So I just moved the stop loss to slightly above the entry price so that it becomes either win or break even game. Now, I am expecting the price to go up to the initial target. But this pull back is huge and it broke the recent lowest downwards, so it might create a range between here and here, but we will see what’s gonna happen.

As you can see, this Tokyo Box strategy is very powerful so if you don’t fully understand how it works, watch the video over time and make sure you understand an be able to apply this in a real chart because this can bring you lot of profit like I do today.

Matane!