This is a recording from last Friday, 24th of May, 2019. I recorded live and explained how I look at a chart from placing an order to making profit on AUD/CAD.

In the recording I mainly explain based on 30min time frame chart. But I do look at a chart multi-time frame from Weekly, Daily and 4H charts.

It took some time to edit the recording because of some microphone issues… but hopefully you enjoy the video.

Watch Video

Script

In this video, I am explaining from placing an order to making a profit, and showing you how I am thinking and feeling during the trade and hopefully it gives you some kind of idea or inspiration for your trading. So here we go!

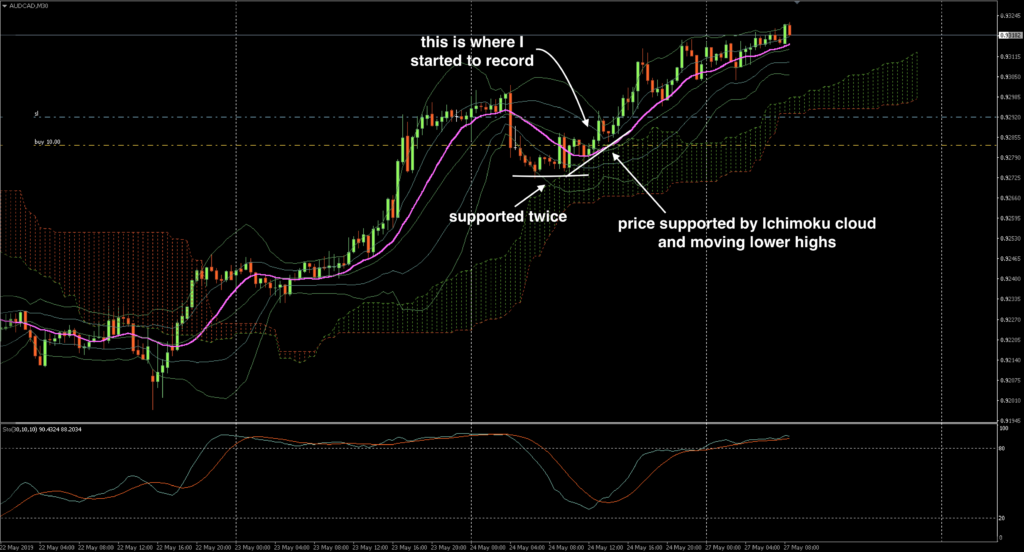

This video was recorded live last Friday on the 24th of May. The chart is AUD/CAD in 30min time frame. As you can see, the current trend is bullish as the price has been above Ichinoku cloud (Kumo), and also has been lower highs and higher highs. Currently the price is right at the Ichinoku cloud, suspecting the price to be supported by the cloud and go above. Also, because the price looks supported twice after the recent bearish price action, the market shows bullish momentum.

So I placed buy order now and see how that works. Another reason why I want to buy at this point is because the current price is right at the bottom of the recent lows, which makes the risk to minimize but can aim for a big profit. And I just placed a Stop Loss at about 22 pips below the entry price because 1. Current price is just above Ichimoku Cloud so if the price goes below the cloud, that means that the environment changed to either range or down trend. and 2. current max volatility for this AUD/CAD is about 22 pips so this is a reasonable place to put the SL.

You might noticed the Stochastics showing dead crossed but I see it’s not really working for this setting for the past few days so I just disregard this one.

Now I expect the price to go up and make profit as always, but in forex world, there’s no assurance for the price to move as your desired direction. And that’s why it’s always better to find a place like this where there is relatively higher possibility for the price to go towards a direction I expect because by keep doing this, I can maximize not only the profit but also the Profit Factor and Max Drawdown.

In Japan it’s still like later afternoon so I will keep watching the market. but if I have something to do or go out for a dinner with my friends, I would place a trailing stop and won’t look at a chart until I can. That’s because I think this is reasonable place to buy and accepted 20pips of loss. It’s not that I am “confident” that the price goes up, but it’s because I accept the loss and think this is a good place for an investment.

Now, let’s see how it goes…

After 6 hours, the price hopefully went up and made some profits.

Now I moved my SL to slightly above the entry price because I can see the price is firm on bullish momentum as it forms lower highs.

If the price is still unstable, like moving up and down, I might not move the SL but recent price action shows that it looks like W bottom and to me, it looks like the bottom is solid and firm.

Also, if you look at the price action, the buy energy is stronger than sell energy, like after 3 big and positive candle sticks, 2 small negative candls, then another 3 big positive candles, then it’s now forming a negative candle stick but now it’s relatively smaller.

Now, if you look at the current price, it’s at the same level as a recent high, that means the price could come back down to the entry price. But it’s ok because even the price comes back down, I won’t lose any money. And I will look for another entry chance like this. So for now, I will expect the price to go further up.

This is 5min chart after few hours from the previous chart. I was getting ready to go to bed because it was already midnight in Japan but as I looked at the chart, I found the price broke the recent highest and up about 27 pips from where I placed buy, making 2,700 USD now.

If you look at the recent price action, before it spikes up, it formed a range, just as it charges its energy for the next move and this time, it went up. Now, I just moved the SL to the slightly below the recent range, ensuring about 9 pips and aiming for further profit.

This is basically what I do every day as a full time individual trader. I look for a place where there’s higher possibility for the price to move the expected direction with minimum loss. And after placing the order, I will just leave it until there’s a certain price action confirmed next.

Sometimes people cannot wait after they place an order like moving SL, cancelling the order, or place an order with opposite direction for any reasons. I guess it depends on what time frame you trade, like if you are a scalper, it might be the case. But if you are a day trader like me, or someone who wants to leverage time and extend a profit as much as possible, it’s something you should not do.

The job of a trader is not just placing an order or taking profits but rather it’s more to wait, wait for the right place for an entry, watch the price action and wait for the right place for exit or take profit. And if you cannot wait and stand still until then, you might lose money and more importantly, you will “regret” to lose money in that way.

But if you learn to wait until a right timing, and if you become used to place orders at the right time, I think that’s the first step to become a successful trader.