This article is about account size in trading, like how much amount of money you should trade with. And this is actually a topic I wanted to talk sometime, but I will talk about one of the common misunderstandings of a trader who has small account size.

When you read books about trading, often times it says “managing your own account, you know, your own fund is important for trading.” Maybe you’ve seen those statements somewhere before. And today I am not gonna talk about like how many pips the loss cut should be or how many % of loss each trade should be, you know, that’s something that I already talked on my previous video, but this time, in this video, I will talk about more important part, the deeper core of how much you should have to start the forex trading.

Watch Video

Smaller account size has less advantage in forex trading?

First of all, let me ask you a question. Do you think forex trading requires a big amount of money?

let me tell you, it doesn’t have to be big. Rather, your account size is better to be kept small until you become stable to win overtime. If you are still a beginner, in theory, you should not put more than one third of your monthly income into account. Then, as you gradually lean and get knowledge and experience, the size of your fund should be increased accordingly as you have better trading results.

“Gradually” is the keyword because you cannot skip a grade in forex trading, like someone who is level 3 cannot be like level 10 suddenly, you know. It’s not gonna happen. Rather, trading is like you move 3 steps forward and take 2 steps back and you repeat that process over and over as a part of learning, so that you enlarge your vessel and get trade experience real time, and you prepare for your budget just as it’s co-related to your own level.

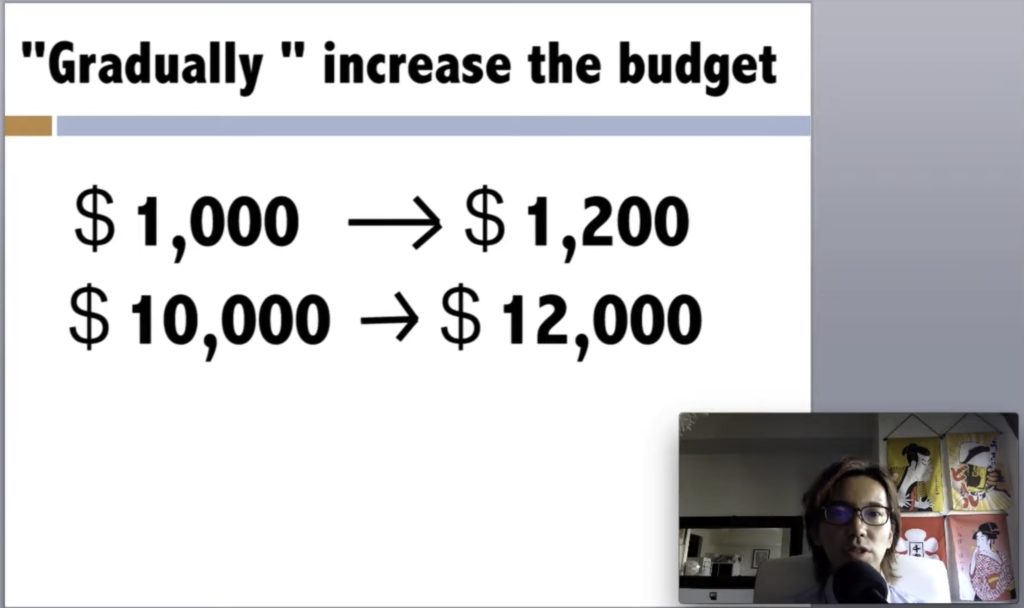

And that’s the ideal way of increasing the account for forex trading, because if you cannot turn $1,000 to $1,200, you cannot turn $10,000 to $12,000. And if you cannot turn $10,000 into $30,000, you cannot turn $100,000 into $300,000.

So, the point is, if you are still struggling with the small amount to turn it into bigger, like for example, still struggling to turn $100 into $120, that means it’s still not a time for you to increase the account size as a whole and position size on each trade.

Try to spot where you can extend the target

Sometimes I see people trade with big lots, big position size after learning a little bit, thinking that they already know how to win, and ends up with losing big. So when you start trading, my recommendation is, instead of spotting a place where you can place big lots, try to spot where you can get big pips instead.

So start with the small amount of money but try to get big pips, that way, your risk on each trade will be smaller than placing big lots but try to look for a spot where the target can be extended. That way, you can convert the risk of losing money into aiming for big target in that sense, and you can survive within the market in a long run.

Cautions when trading with big account

So far, it may sound like trading with big account and big lot is not good. But it’s not really true because let me explain a good part of trading with big amount of money.

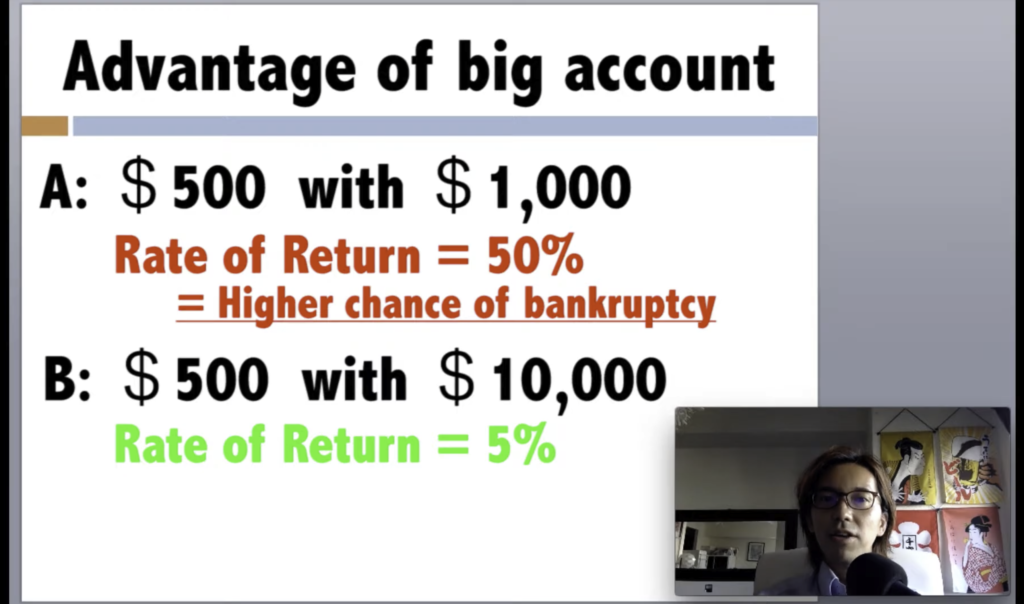

For example, let’s say there’s a trader A who tries to make $500 with $1,000 in his account and let’s say the other trader B tries to make the same $500 with $10,000 in his account, when you compare these trades, which one has advantage? The answer is in the rate of return on each trader.

When trader A tries to make $500 with $1,000 in his account, the rate of return is going to be 50%, but when trader B tries to make the same $500 with $10,000 in his account, the rate of return of this trader B is going to be just 5%, so the trader B is obviously on an easy game.

So the more you try to earn money with smaller amount of money, the more the rate of bankruptcy it increases. So if you decide to put your real money into trading and if you are thinking to start with small amount of money, I know you are pumped up to earn money, but first of all, you need to trade with smaller lot sizing. 2% of loss cut is ideal on each trade but try to extend the distance, you know, try to spot a place where you can get bigger pips instead. And increase the lot size as your account gets bigger accordingly.

Think trading with small amount money is a good chance

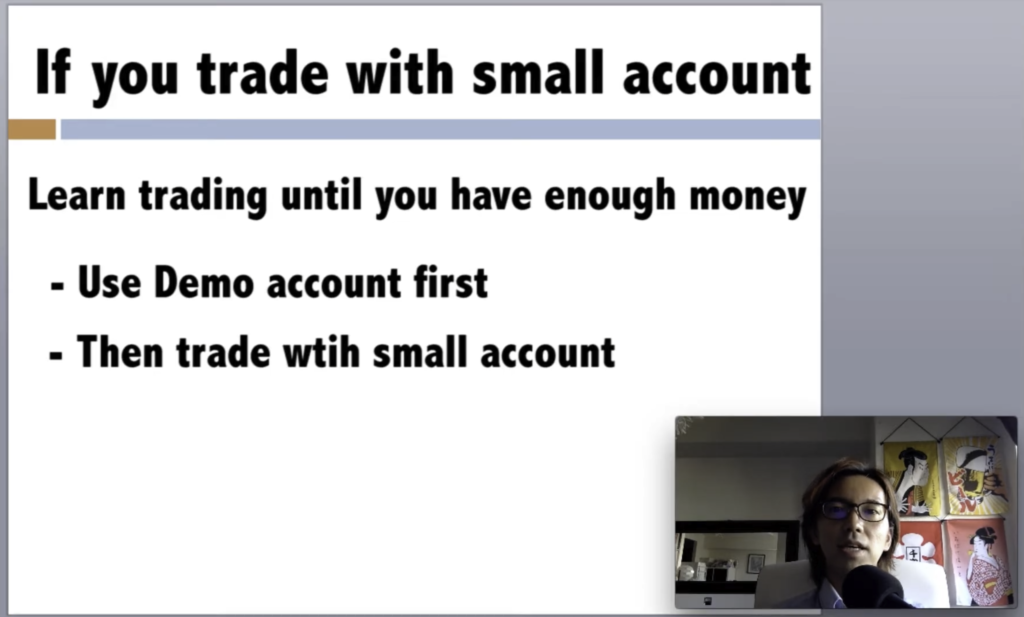

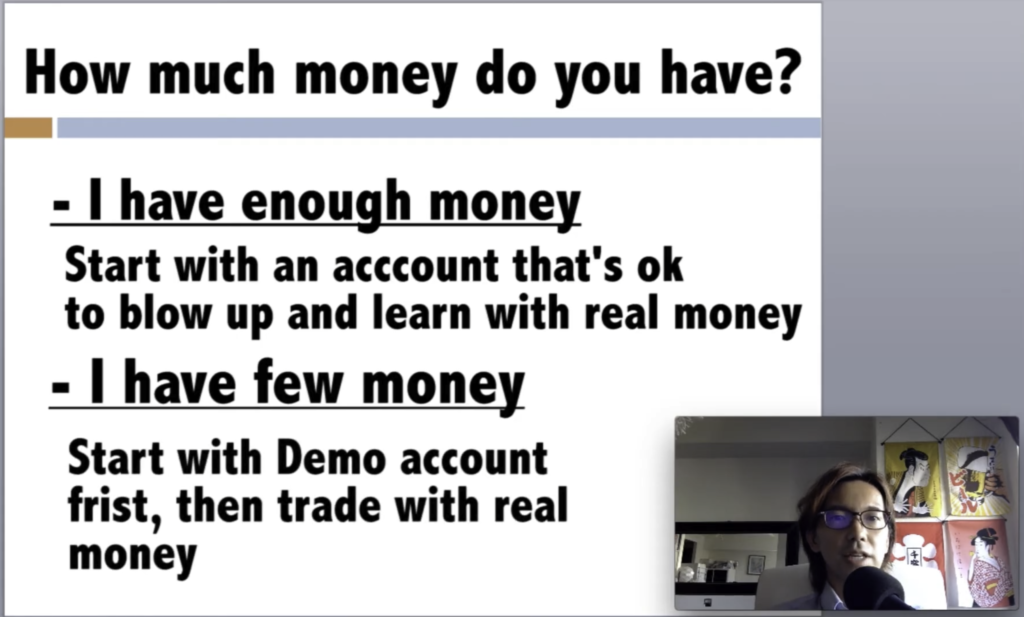

So if you think about these things, those who think who cannot trade because of not having enough money, it’s actually a chance because you can learn and prepare for the real trading, you know, until you have enough money to trade. You have time to learn from books or videos like this, and get enough knowledge and start applying it with demo trading first, and prepare to increase the level of your trade.

Then after the demo trading, you can start to put small amount into real trade account and start trading with that account because demo trading is good for testing your strategy, but it cannot train your mental part because it’s not a real money. So after learning and done with demo trading, I recommend you to trade with real account with small amount of money that you think you are ok to lose, and train your mental part in that way.

Start small even if you have enough money

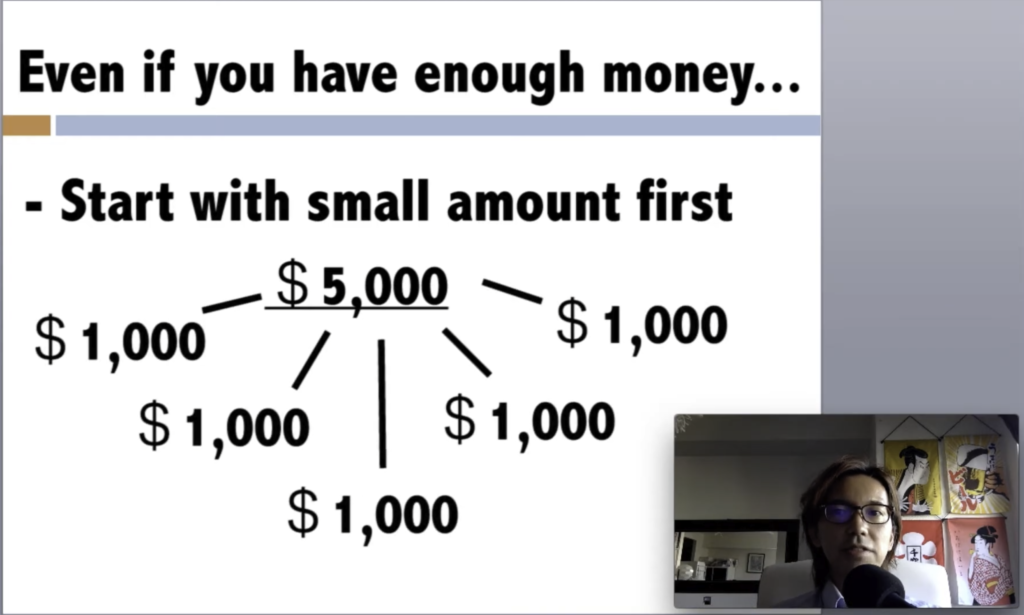

So practically speaking, for those who just started trading, even when you have enough money to trade, I recommend you to start with small amount. For example, if you have $5,000, then you divide it into $1,000 times 5 and start trading.

You know, we are here to trade and earn money, right?

But sometimes people when they just started trading, he is all pumped up and hope to get profit within a day. And if you have the available money right in front of you, you try to win back the previous loss by placing more positions or by increasing the lot sizing. So for those who are not yet confident enough, it’s important that you create trade plans on a premise that you lose all the money in your account. And start trading for the purpose of learning something from it at first. Because if you trade on a premise of blowing up your account, you wanna start small, right?

So for those who have enough money to start trading, you still better to start with small account, with the account size that you think it’s ok to blow up and get real trade experience along with Demo trading. And those have small account size in trading first, you don’t have to worry about it.

All you have to do is once you get the basic knowledge, start trading with demo account, and get enough experience, then start trading with real money with small account size that you think it’s ok to be gone. Like I mentioned on the previous video, you cannot run out of bullets in a battle field. And you can always come back to demo trading if you are still not confident.

Take advantage of Forex Tester

Well, there’s a tool that I highly recommend for your training, and it’s called Forex Tester, that you can move back and forward the charts in many currency pairs with multiple time frame, and the best part about it is you can run the chart even during the weekend when the market is closed.

Now they have the latest version 4 just launched and I use it every week, when the market is silent or when there’s no chance to trade, I just open it and train myself with my own strategy. So I highly recommend you to try it out if you haven’t tried yet. I will put the link below so you can check it out.

So anyways, even if you have a small amount of money, it’s ok, because each trade should be executed according to how much you have. And at first, you can always start small. And as your performance gets better, start trading with bigger size.

But never trade with big lots from the beginning even if you have lots of money. You need to know your performance at least, like profit factor, winning and losing rate, max drawdown, things like that. But if you don’t know it, use demo account or forex tester until you are confident on your strategy.

Never rush into making profit. The winner in forex trading is always the turtle, not the rabbit.