Why there are people who win and who lose in forex trading?

That’s because “what” and “how” they study is different.

Holy grail is in you

As compared with any skills, trade is the same as driving and sports. And you can never be successful just understanding with your head. You can move your body in unconscious level when your head and body connects altogether. When you start trading, many people start searching for holy grails. And ironically, those who realized that there is no such thing as the Holy Grail starts to walk along the pathway of a winner.

Let go of unnecessary knowledge

A variety of information is everywhere on the internet, whether it be free or paid. The journey to find the Holy Grail begins with this excess information. We roll around various indicators, purchase information materials that cost $500, or buy sign tools or signal delivery to inform where to place positions. However, you still cannot win by trades and your asset keeps decreasing.

If you are in a similar situation, I recommend you to discard unnecessary information first. FX is different from exam study, it does not let you win by the amount of knowledge. The point is to gain experience to transform just one good piece of knowledge into a skill. There are many types of traders, but people who repeats practicing only one thing tend to continue to win as a result.

You lose when you are trapped into techniques

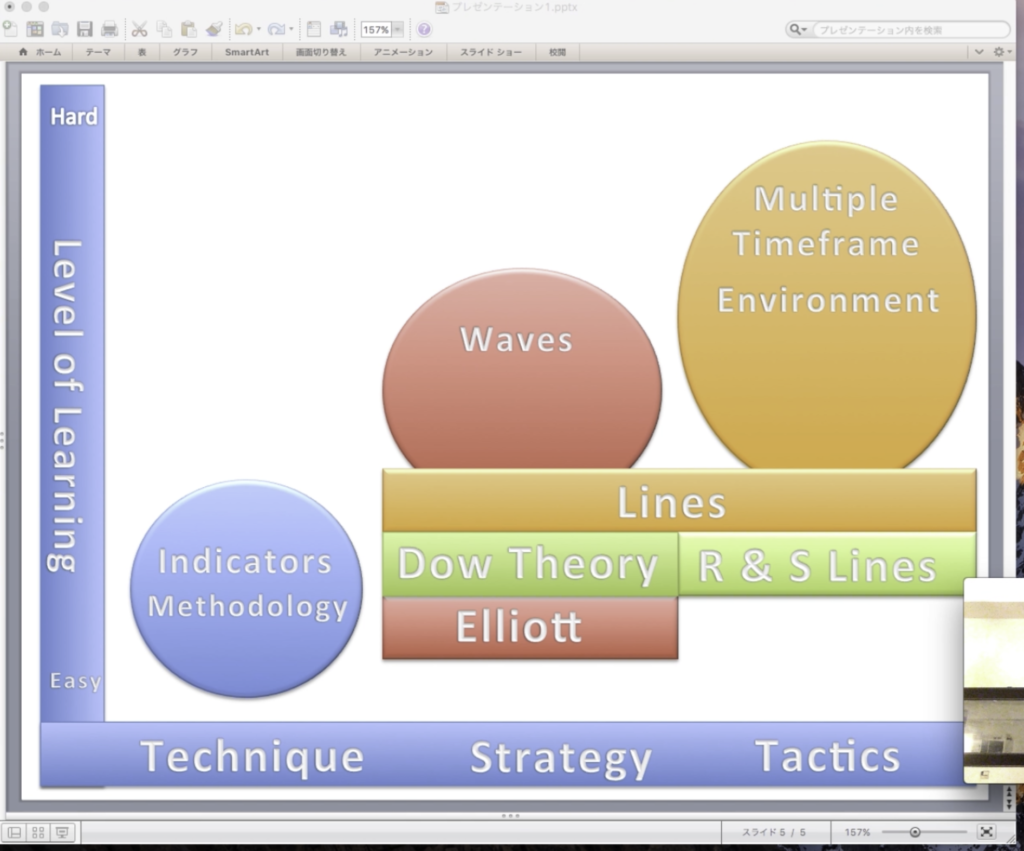

Most of the information available on the internet is at the technical level. Techniques are like weapons but just because you know this, it doesn’t mean you can win. All you need is the ability to create tactics, that is, the scenario. And the only way to acquire scenario skills is training to draw lines on the chart.

The so-called “methods” by means of indicators such as moving average gold/dead crosses, or MACD and they are just techniques, so it is nothing more than get the timing of entry. These indicators are easy to sell as they can easily make people feel win, but it doesn’t mean those who bought the indicators can win. Honestly, indicators are very easy to create, and there is no perfect ones.

The market is a game that predicts the point where the wave turns, so no matter what method you use, you will win if the price goes towards the direction you imagined, and lose when it goes backwards, and that’s it.

Less is more. If you have some knowledge, just practice

The first step is to think simple.

Erase all indicators from the chart and try to make them naked. In the day trading, you just need to draw resistance and a support line that seem to stop on the 1-hour to daily charts, and trade between those prices. If there is a trend in one hour, you can predict the point of buying for a push back, and wait if it is trendless. If it is a range of 50 pips or more, it will be short from near the resistance line, long from support line. If you make the chart simple, you can see what you have not seen before.

All you need to operate your bicycle is the 3 things, a pedal, a handle and brakes. Similarly, there are just three things you need to know to read the chart, candlestick, wave, and lines. If you attach too much extra things, you can not see what you see.