Profit management is just like a shield to fight on the battlefield called “Forex.”

It is not courage but foolish to fight without knowing how to protect yourself.

The importance of learning to survive

A competitive trade is a surviving trade. It is said that 70% of the FX participants will eventually leave, but only those who survive to the end will receive continuous benefits.

If you know how to survive without leaving, even if it takes time to learn, you will be able to join the winning traders group.

Nothing is more important than NOT GIVING UP. The same can be said for business and study. But in forex, when your account is exhausted, you will have no choice other than giving up even though you wish to continue.

In order not to be like that, it is necessary to avoid reducing the money in extreme way.

As a beginner’s mindset, it is good to think “I’m studying for myself with some expenses” for your loss. However, you will have plenty of time to study without reducing your money if you have well-managed account.

Attack with a technical sword and protect with a profit management shield

Everyone is conscious only to win, but equally important is to save money. Unlike technical management, knowledge on profit management can be used forever once it is remembered, so I really recommend you to take this opportunity to learn it.

Technical tools can not let you win 100% no matter how much you study, but if you follow the rules of money and profit management, the worst situation of leaving the game can be avoided.

Trade in the correct position size that the bullet is not exhausted

Loss of one trade should be up to 2% of your account balance.

If you are a beginner, make it 1% of your available balance.

Loss is not simply determined by how many pips you lost, but is calculated from your account size and average loss pips.

Average loss = Total loss (in pips) ÷ Number of lost trades (Average loss is in pips)

Assuming your average loss is 10 pips, look at a table below.

| Account Size | Loss cut (%) | Loss Cut (Amount) | Right Position Size |

| $1,000 | 1% | $10 | 0.1 lot |

| $1,000 | 2% | $20 | 0.2 lot |

| $5,000 | 1% | $50 | 0.5 lot |

| $5,000 | 2% | $100 | 1.0 lot |

| $10,000 | 1% | $100 | 1.0 lot |

| $10,000 | 2% | $200 | 2.0 lot |

The only way not to run out and and secure your money is to adjust the position size (open position) according to the amount of your account size. There is a theory called Prospect Theory, but people tend to take profit quicker than cutting loss. So to keep trading without mental collapse, do not take unreasonable positions.

If you trade many times within a day, like scalping, wide spread can be a great obstacle. For example, if you trade 10 times in a day in average, you will have a total of 200 entries a month. When 1.0 pip of spread per entry occurs, that means a total of 200 pips will disappear just for spread regardless of the outcome. This is equivalent to $2,000 USD. It’s huge, isn’t it?

Three numbers to protect your precious account

Winning rate = number of win trades ÷ total number of trades

PF (Profit Factor) = Total profit (in Pips) ÷ Total loss (in Pips) If PF is 1, that’s break even.

R multiple = average profit (in pips) ÷ average loss (in pips)

| PF | R Multiple | Winning Rate |

| 1.0 | 0.3 | 0.77 |

| 1.0 | 0.5 | 0.67 |

| 1.0 | 1.0 | 0.50 |

| 1.0 | 1.0 | 0.40 |

| 1.0 | 2.0 | 0.33 |

| 1.0 | 2.5 | 0.29 |

| 1.0 | 3.0 | 0.25 |

First, aim for Winning rate = 0.5, PF = 1, R multiple = 1 becomes ± 0 (break even result).

If you have not reached 1R now, it will be urgent to achieve it first. It is quite difficult to raise the winning rate, but the R multiple can be controlled depending on the entry method. If it becomes over 1R, profit will surely remain even if the winning percentage is 50%.

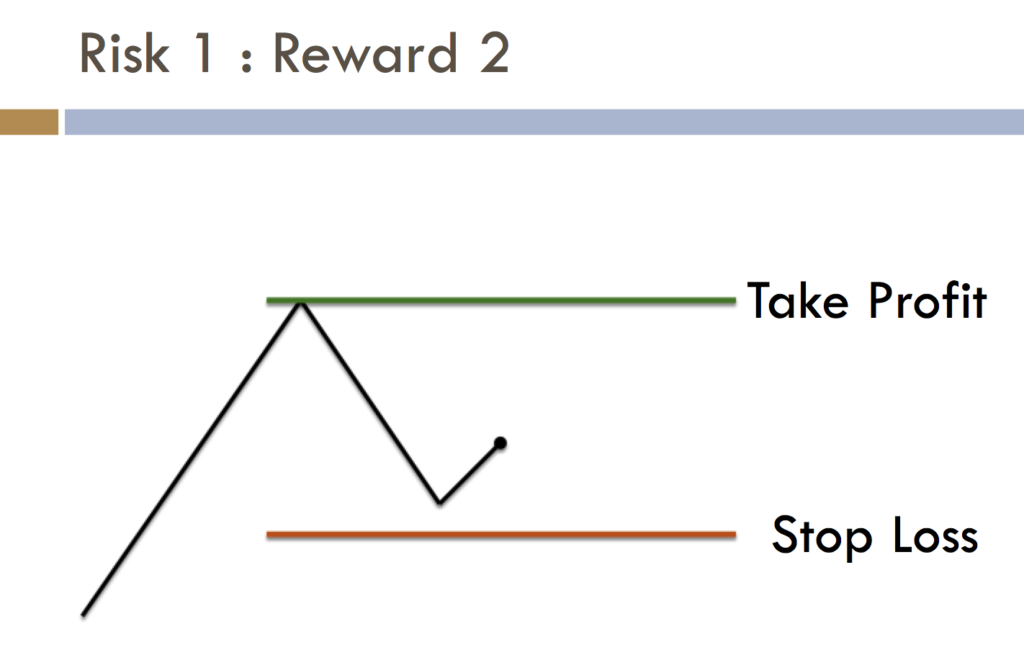

Risk / reward concept for small loss, big profit trades

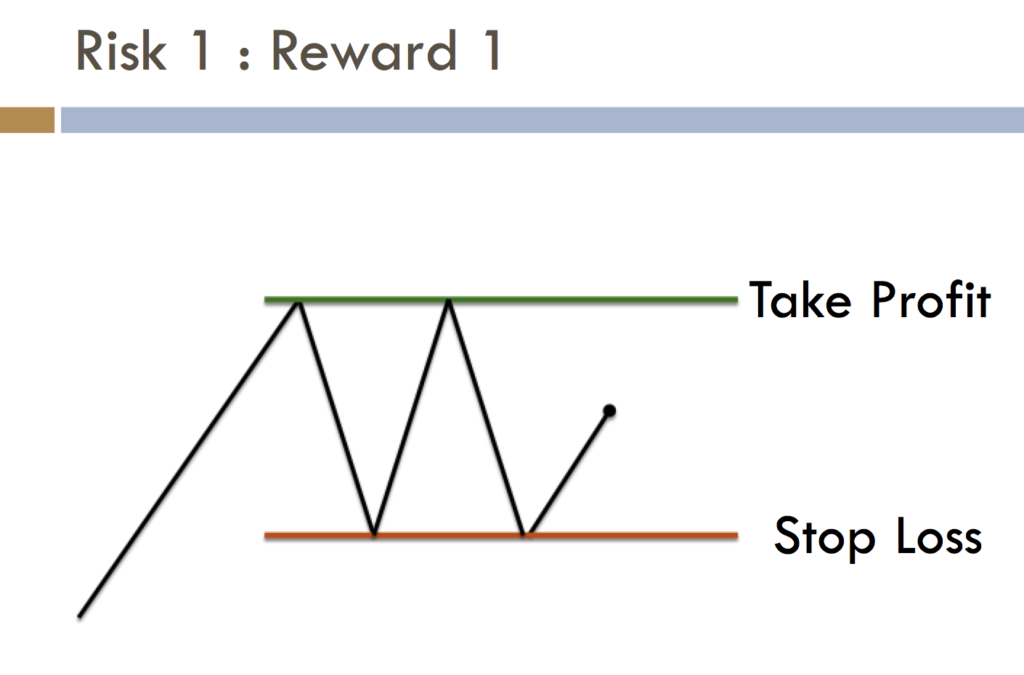

Suppose you create a rule that you enter only where you can secure Risk 1 vs. Rewards 2 or more. In this case, if the winning rate is 50%, it will be 2R and you will surely have a profit. It’s small loss, big profit trades. Under this condition, even if the price action is simmering in the middle and comes back before it hits the target, it should be about risk 1: reward 1 trade.

The risk 1 to reward 1 entry is 1R with a 50% win rate, and the result become break even. And that’s even when you take the profit on the target. In fact, usually the price often does not reach the target, resulting in small losses. If you get used to trades, you can place your orders in this kind of situation but that’s because you know the trade could be small profit, big loss, and it is different from placing orders blindly.

Risk rewards ratio of 1: 3 and above is not very realistic for a day traders or scalpers, but risk reward 1: 2 offers many opportunities. After that, you should stick to your entry accuracy and raise the winning rate.

Conclusion

Joining the forex market without profit and account management is just as dangerous as climbing to Mt. Everest without knowing how to tie the lifeline ropes. This is important as related almost to your life, so check the numbers with your recent trading results. Analyze data from the last 20 trades to 100 trades at least and try to get the R multiple and the winning percentage.

Please download and use the Excel spreadsheet as attached below.

Contact

- Your questions or messages may be answered or shared on my videos. Your personal information (name and email address) are not going to be disclosed, but if you are not comfortable, then put that on the message.

- This website is run by myself only, therefore it may take few days to reply. If there is no response even after one week, there is a possibility that the message is missing, so please resend it.